Introduction: US trade with China weakening

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Donald Trump’s trade war is weakening the US economy and causing a plunge in trade with China, economists and logistics firms are warning.

Nearly four week’s after Trump’s ‘Liberation Day’ announcement of higher tariffs triggered a trade war with Beijing, evidence is mounting that businesses and consumers are cutting back.

Torsten Sløk, chief executive at asset manager Apollo Global Management, explains:

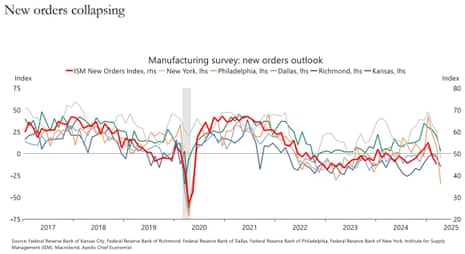

For companies, new orders are falling, capex plans are declining, inventories were rising before tariffs took effect, and firms are revising down earnings expectations.

For households, consumer confidence is at record-low levels, consumers were front-loading purchases before tariffs began, and tourism is slowing, in particular international travel.

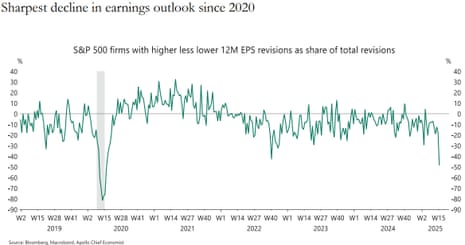

Sløk has pulled together a chartbook highlighting the damage to company earnings…

…on new orders…

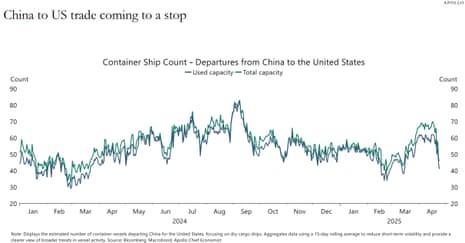

…and notably on trade with China.

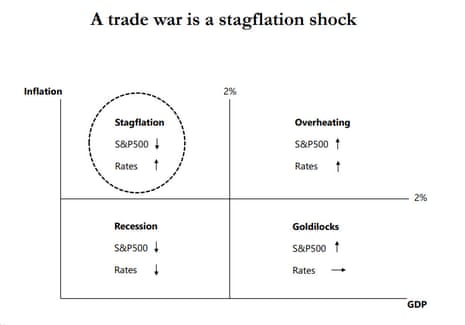

A trade war is a “stagflation shock”, Sløk fears.

He explains that it typically takes between 20 and 40 days for a sea container to travel from China to the US. That means that the slowdown in container departures from China to the US which started in early April will be felt at US ports in early and mid-May.

That would hit demand for trucking from mid-May, leading to empty shelves and layoffs in trucking and retail industry, causing what Sløk dubs “The Voluntary Trade Reset Recession”.

Sløk warned on Friday:

In May, we will begin to see significant layoffs in trucking, logistics, and retail — particularly in small businesses such as your independent toy store, your independent hardware store, and your independent men’s clothing store.

With 9 million people working in trucking-related jobs and 16 million people working in the retail sector, the downside risks to the economy are significant.

There are signs today that this trade slowdown is underway, due to the 145% tariff imposed on Chinese imports to the US.

The Financial Times reports this morning that the Port of Los Angeles, the main route of entry for goods from China, expects scheduled arrivals in the week starting 4 May to be a third lower than a year before.

The new higher tariffs announced on other countries are currently paused, of course, while the US negotiates new trade deals.

Trump has claimed to Time Magazine that he’s made 200 deals. But this appears to be, well, an exaggeration.

US Treasury secretary Scott Bessent told ABC News he believes Trump is “referring to sub deals within the negotiations we’re doing.”

Bessent insisted, though, that progress is being made, arguing:

If there are 180 countries, there are 18 important trading partners, let’s put China to the side, because that’s a special negotiation, there’s 17 important trading partners, and we have a process in place, over the next 90 days, to negotiate with them. Some of those are moving along very well, especially with the Asian countries.

Treasury Secretary Scott Bessent defended President Donald Trump’s negotiating strategy on trade deals but said he didn’t know whether Trump was speaking directly with Chinese President Xi Jinping. https://t.co/kOqQ2STvOf

— ABC News (@ABC) April 27, 2025

Last week, shipping giant Hapag-Lloyd reported that its customers have cancelled 30% of shipments to the United States from China….and there has been a “massive increase” in demand for consignments from Thailand, Cambodia and Vietnam instead.

The agenda

-

11am BST: CBI’s distributive trades survey of UK retailing

-

11am BST: France’s unemployment data for March

-

3.30pm BST: Dallas Fed manufacturing index for April

Key events

FTSE 100 on track for 11th rise in a row

Britain’s stock market is on track to match its longest run of gains in eight years.

The FTSE 100 index has risen by 20 points, or 0.25%, in early trading to 8436 points. That puts the blue-chip shares index on track for its 11th daily rise in a row, a record last set in December 2019 after Boris Johnson’s election win.

The FTSE 100 last set a longer winning run from late-December 2016 to mid-January 2017, when it rose for 14 days on the trot.

The recovery over the last few weeks has been helped by the US pausing many of its tariffs on trading partners (tho not China)

These recent gains have not fully recovered the losses after Donald Trump’s announcement of new global tariffs, though, as this chart shows:

For April as a whole, the FTSE 100 is still down 1.7%.

M&S shares drop again as cyber disruption continues

Marks & Spencer are leading the FTSE 100 fallers this morning, as it reels from the damage caused by a cyber attack.

Shares in M&S are down 2.3% this morning at 376p, as traders digest the ongoing disruption at the company.

On Friday it halted all orders through its website and apps, and encouraged customers to visit its stores instead.

The cyber incident began a week ago, on Easter Monday, affecting contactless payments and click-and-collect orders in stores across the UK. M&S disclosed it on Tuesday, saying a “cyber incident” affected contactless payments and the pick up of online orders in its stores in recent days.

Shares in M&S have dropped by over 8% since then, having closed at 411p before Easter.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, says the ongoing problems underline how difficult the breach has been to get a handle on.

Streeter points out that the suspension of online orders will be hugely damaging for sales, adding:

Marks and Spencer’s recent run of success has been partly down to how it been so efficient at managing its multi-channel operations with click and collect services particularly popular.

It’s been reducing its store footprint focusing on smaller food stores where customers can swing buy and pick up products bought online. This ease of shopping and delivery has been upended. Even though stores are open, many simply don’t stock the popular ranges from online.

Fashion sales are likely to take a big hit particularly as the attack has come during the spell of warm weather when summer ranges would ordinarily be piling up in virtual baskets. While other retailers have not been immune to IT breaches, the depth of Marks and Spencer’s problems in resolving the issue are worrying, and it may take some time to win back some more warier shoppers.

Deliveroo shares jump 17% after DoorDash takeover approach

Shares in food delivery group Deliveroo have jumped by 17% at the start of trading in London, after receiving a takeover approach from US rival DoorDash.

On Friday night, the news broke that DoorDash had offered to buy Deliveroo for $3.6bn (£2.7bn).

Deliveroo said that received an indicative proposal from DoorDash for a possible cash offer worth 180p per share, and that it would be “minded to recommend such an offer to Deliveroo shareholders”.

Its shares have jumped to 170p this morning….

This morning, Deliveroo also announced that it has suspended its £100m share buyback programme, due to the approach from DoorDash.

DoorDash’s interest comes four years after Deliveroo floated on the London stock market, in what has been called the City’s worst IPO ever.

Deliveroo’s shares were priced at 390p each, but slumped by a quarter on the first day of trading – causing the firm to be dubbed “Flopperoo”.

The Times points out today that if the DoorDash deal goes through at 180p, Deliveroo founder Will Shu would receive a payout of more than £172m, based upon his 5.9% stake

UK growth forecast to slow sharply as Trump tariffs hit economy

Mark Sweney

The UK economy is set to slow sharply for the next two years as Donald Trump’s global tariff war weighs on consumer spending and business investment, a study by a leading forecaster has predicted.

The EY Item Club is now forecasting that UK gross domestic product (GDP) will grow by 0.8% this year, down from a projection of 1% in February, and has cut its 2026 forecast from 1.6% to 0.9% as longer-term effects hit the UK.

Bloomberg: Shein hikes US prices by up to 377%

American customers of fast-fashion giant Shein are now feeling the impact of the trade war.

Shein raised the US prices of a swathe of products on Friday, Bloomberg reported, in anticipation of new tariffs on small parcels.

Over to Bloomberg for the details:

The average price for the top 100 products in the beauty and health category increased by 51% from Thursday, with several of the items more than doubling in price.

For home and kitchen products and toys, the average jump was more than 30%, led by a massive 377% increase in the price of a 10-piece set of kitchen towels. For women’s clothing the rise was 8%.

This follows Donald Trump’s decision to end the “de minimis” exemption for small packages from mainland China and Hong Kong. which had meant that packages under $800 did not qualify for any taxes or tariffs.

China confident of achieving 2025 growth target, says state planner

China’s policymakers are insisting today that they will hit this year’s growth targets, despite the impact of Donald Trump’s tariffs.

The vice head of China’s state planner said on Monday he was “fully confident” that the world’s second-largest economy would achieve its economic growth target of around 5% for 2025.

Zhao Chenxin, vice chair of the National Development and Reform Commission, told a press conference that new policies will be rolled out over the second quarter, based on changes in the economic situation.

Zhao said:

“The achievements of the first quarter have laid a solid foundation for the economic development of the whole year.

No matter how the international situation changes, we will anchor our development goals, maintain strategic focus and concentrate on doing our own thing.”

Introduction: US trade with China weakening

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Donald Trump’s trade war is weakening the US economy and causing a plunge in trade with China, economists and logistics firms are warning.

Nearly four week’s after Trump’s ‘Liberation Day’ announcement of higher tariffs triggered a trade war with Beijing, evidence is mounting that businesses and consumers are cutting back.

Torsten Sløk, chief executive at asset manager Apollo Global Management, explains:

For companies, new orders are falling, capex plans are declining, inventories were rising before tariffs took effect, and firms are revising down earnings expectations.

For households, consumer confidence is at record-low levels, consumers were front-loading purchases before tariffs began, and tourism is slowing, in particular international travel.

Sløk has pulled together a chartbook highlighting the damage to company earnings…

…on new orders…

…and notably on trade with China.

A trade war is a “stagflation shock”, Sløk fears.

He explains that it typically takes between 20 and 40 days for a sea container to travel from China to the US. That means that the slowdown in container departures from China to the US which started in early April will be felt at US ports in early and mid-May.

That would hit demand for trucking from mid-May, leading to empty shelves and layoffs in trucking and retail industry, causing what Sløk dubs “The Voluntary Trade Reset Recession”.

Sløk warned on Friday:

In May, we will begin to see significant layoffs in trucking, logistics, and retail — particularly in small businesses such as your independent toy store, your independent hardware store, and your independent men’s clothing store.

With 9 million people working in trucking-related jobs and 16 million people working in the retail sector, the downside risks to the economy are significant.

There are signs today that this trade slowdown is underway, due to the 145% tariff imposed on Chinese imports to the US.

The Financial Times reports this morning that the Port of Los Angeles, the main route of entry for goods from China, expects scheduled arrivals in the week starting 4 May to be a third lower than a year before.

The new higher tariffs announced on other countries are currently paused, of course, while the US negotiates new trade deals.

Trump has claimed to Time Magazine that he’s made 200 deals. But this appears to be, well, an exaggeration.

US Treasury secretary Scott Bessent told ABC News he believes Trump is “referring to sub deals within the negotiations we’re doing.”

Bessent insisted, though, that progress is being made, arguing:

If there are 180 countries, there are 18 important trading partners, let’s put China to the side, because that’s a special negotiation, there’s 17 important trading partners, and we have a process in place, over the next 90 days, to negotiate with them. Some of those are moving along very well, especially with the Asian countries.

Treasury Secretary Scott Bessent defended President Donald Trump’s negotiating strategy on trade deals but said he didn’t know whether Trump was speaking directly with Chinese President Xi Jinping. https://t.co/kOqQ2STvOf

— ABC News (@ABC) April 27, 2025

Last week, shipping giant Hapag-Lloyd reported that its customers have cancelled 30% of shipments to the United States from China….and there has been a “massive increase” in demand for consignments from Thailand, Cambodia and Vietnam instead.

The agenda

-

11am BST: CBI’s distributive trades survey of UK retailing

-

11am BST: France’s unemployment data for March

-

3.30pm BST: Dallas Fed manufacturing index for April